TurboTax Review 2023: How TurboTax Works

Thanks for reading! This article is sponsored by TurboTax. All services featured were hand-picked and thoughtfully chosen by our editorial team, and any items listed below were in-stock with accurate pricing at the time of publication.

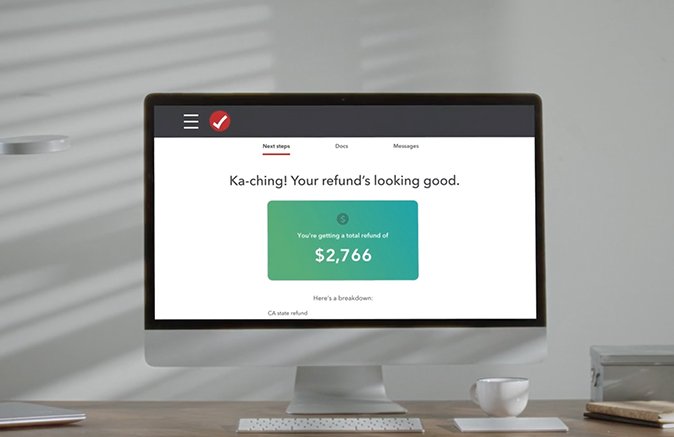

As the old Benjamin Franklin saying goes, “There is nothing constant in our world except death and taxes" (there’s also our undying love of tacos, but we aren’t sure old Ben ever had one of those). Doing your taxes might feel about as fun as watching paint dry, but TurboTax is out to make the process as painless as possible. Plus, if you have simple tax returns, you might be able to file your taxes with TurboTax for free. Read on to learn more about the sign-up process, tax services, the pros and cons, and more!

Jump to:

Who Is TurboTax Best For?

Taxpayers who are looking for the convenience of a streamlined tax preparation process or want to chat with a licensed tax professional will love the variety of services TurboTax offers. This is especially true for those with multiple income streams — TurboTax offers services for 1099s, W-2, undeclared cash pay, and a bunch of documents we’ve never heard of.

In short, while TurboTax may not be necessary for those with little to no change in their year-to-year employment situation, it’s a huge plus for freelancers, hustlers, couples, or those who want a convenient way to safely hand off the tedium of their yearly taxes to a professional.

>> Related resource: Becoming a Millionaire Calculator

How to signup for TurboTax service?

Signing up for TurboTax is incredibly easy — just visit their website and enter an email, user ID, and create a password to get started. It’ll ask you to include a phone number for password recovery and two-step verification options, but it isn’t mandatory to create an account.

Once you’ve signed up, you’re all ready to start filing. If you want all your financial information in one convenient place, though, you can link existing Quickbooks or Mint accounts for easy access.

>> Also check out: Savings.com Rule of 72 Investment Calculator

TurboTax Services

TurboTax offers a variety of tax services and packages depending on the features you’re after. Keep reading for a breakdown of TurboTax’s services and our recommendations for the best ones to go with.

TurboTax Free Edition

Price: $0

Best For: Simple tax returns (W-2 only)

TurboTax’s free package is as simple as taxes can get — just enter your W-2 information, answer a few additional questions, and you’re set! This option is a quick in-and-out option for taxpayers who have a stable situation. If you received something other than a standard W-2, you’ll need to look for a different option.

TurboTax Deluxe Edition

Price: $59

Best For: Maximizing deductions and tax breaks

If you like the idea of taking back a chunk of your hard-earned money from Uncle Sam, the TurboTax Deluxe package is made for you. TurboTax asks you questions covering over 350 possible tax breaks to help ensure that you keep as much of your money as possible. You’ll pay for the additional questions, but it’ll pay for itself easily as the deductions and breaks pile up. Taxes may not be very fun, but the Deluxe package is as close as you’re likely to get.

TurboTax Premier Edition

Price: $89

Best For: Managing rental properties and diverse investment portfolios

If there’s one thing more complex than tax procedure, it’s real estate documentation. Thankfully, TurboTax has got homeowners and property managers covered with their Premier package. In addition to the features offered in the free edition, Premier covers rental properties, real estate tax-break situations, and even stock, ETF, and cryptocurrency investments. Manually enter your information or import your documentation in a snap and file your taxes stress-free, no matter how diverse your portfolio gets.

TurboTax Self-Employment Edition

Price: $119

Best For: Managing multiple streams of income/1099 forms

The gig economy goes by a lot of names — whether you’re chasing the bag, getting that bread, or staying on the hustle, TurboTax is ready for you. The hustle can get pretty complicated, especially when you’re managing multiple income streams, expense lists, and non-standard employment situations all at once. Take the “huh" out of your hustle with the Self-Employed package from TurboTax. We’ve used this option, and love that it offers industry-specific expense questions. For instance, bakers might be asked about the costs of their food container and equipment costs, while writers may be asked about supplies, workspaces, and more. If you had more hustle than a professional football team this past year, the Self-Employment edition is likely the best for you.

Read more: Best Tax Filing Deals and Services in 2022

TurboTax Overview: The Pros and Cons

It’s important to make sure you’re happy with the service you choose to help with taxes. Still on the fence about TurboTax? Here’s a list of our favorite features and foremost frustrations for you to consider:

Pros

- TurboTax makes filing your taxes incredibly convenient and much faster than doing it on your own (especially for more complicated situations).

- You can pay for TurboTax straight out of your return.

- Users don’t pay at all until they file, so they can press the eject button at any time.

- Audits are rare for most individuals, but TurboTax offers personal 1-to-1 guidance for all of its users if they do get audited.

- The site uses everyday language without all the technical jargon, so navigating is super easy.

- TurboTax saves your info between returns and allows for easy document importation to eliminate some of the tedium from the filing process.

Cons

- TurboTax is very active about up-charging for services — we wish everything was listed as upfront costs.

- You won’t run into problems often, but the automated system is not very helpful when problems do occur.

- Some users complain that information can be marked for review without a clear explanation.

- State taxes cost extra for all but the free edition (remember our note on up-charges?).

Frequently Asked Questions

How does TurboTax know what questions to ask?

TurboTax starts by asking general questions about yourself. Then, based on your answers, it helps find deductions and credits unique to your situation. For example, if you tell them you have children, the service will look for deductions and credits such as child tax care credit, earned income credit, and more.

What if I make a mistake on my return?

TurboTax checks for errors along the way, but sometimes mistakes happen. However, the service guarantees its return calculations and will pay any IRS penalties, plus interest, if your return is different from what’s listed on your account.

What if I don’t have a bank account?

TurboTax is a great pick for taxpayers in all kinds of situations — if you don’t have a bank account to transfer your return to, the service can transfer the money to a reloadable debit card.

What if I have questions along the way?

The easiest way to get personalized, one-on-one answers is to visit the TurboTax support page. It offers a search function for your questions as well as a community forum where you can ask and answer questions from other users.